20962 - The Achilles reserve causes strategic institutional concerns

Ε. Conophagos, N. Lygeros

Translated from the Greek by Athena Kehagias

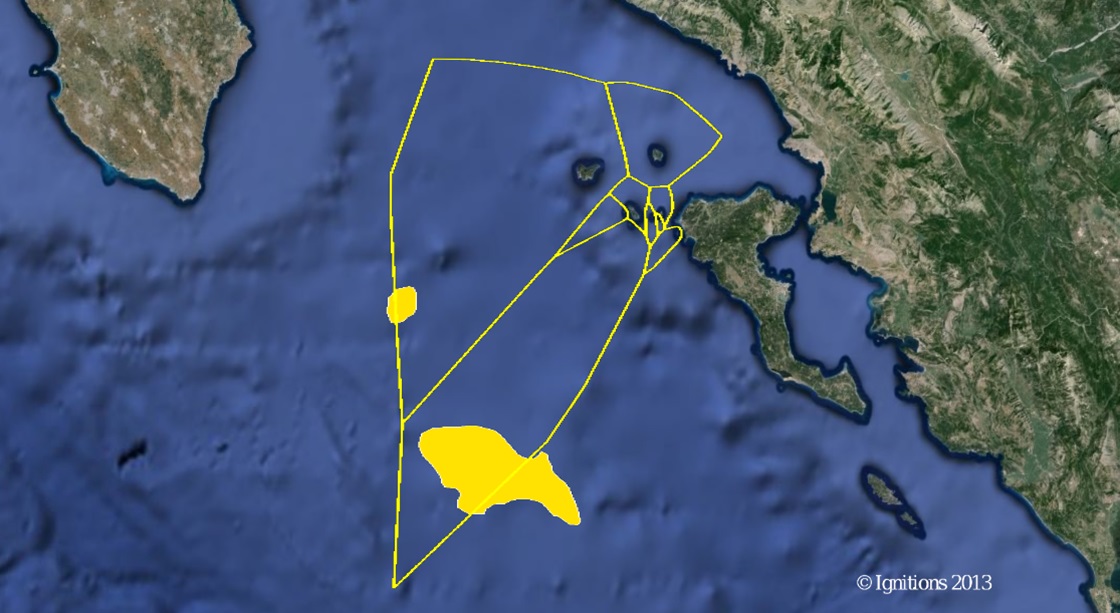

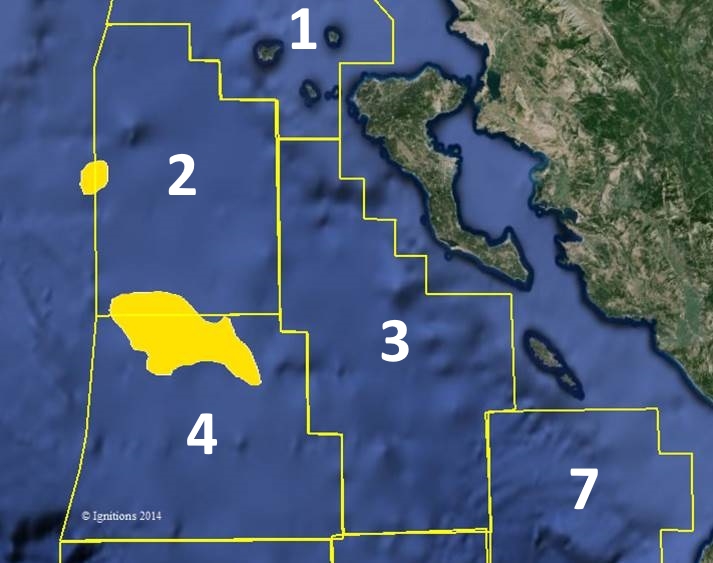

The problem regarding the Achilles reserve, which is clearly within the Greek EEZ, is that it’s divided in two sections.

1/3 of it is within marine plot 2 and the 2/3 in the one below, ie, marine plot 4.

This is not at all possitive for someone who wants to invest in the region, unless of course they have other aspirations for a later stage.

The hydrocarbon Act needs to be amended, in order for it to become more flexible, so as to accomodate issues, in the event of an important discovery in such an area, as it happens in the case of the Achilles reserve.

The reason is strategically economic.

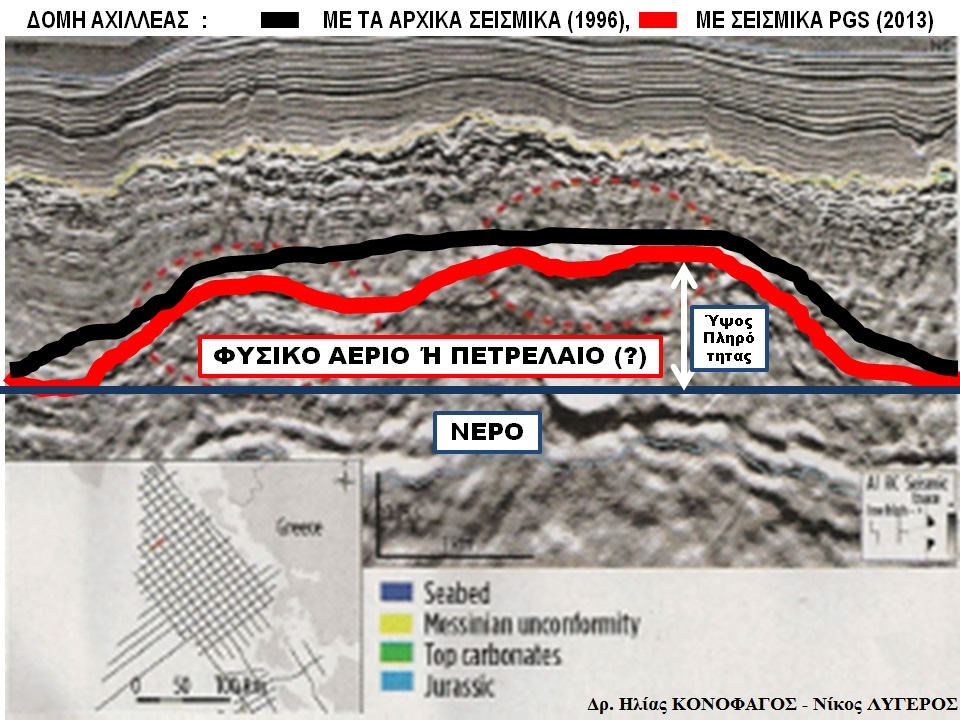

More specifically, because the geological structure of the reserve is limestone, i.e. with low porosity <10%, in contrast to the reserve Aphrodite, in which the geological structure of the formation is sandstone, i.e. sand with high porosity> 20%, the detection drilling costs if the reserve has a throughout uniformity in regards to its exploitation, in order for an exploitation loan to be obtained, are much higher than those which occurred in the Cypriot EEZ.

Therefore, the Law regarding the hydrocarbons, as well as the corresponding notice and concession contract, should protect the contractor both practically and tax ways, e.g.

In the case of several evaluation drillings, at 1,000 meters water depth, as is the Achilles reserve case, production tests (or combustion) should take place, and this could take several months.

During this period, the contractor should be able, in order to reduce costs – where oil is concerned- to sell his products on the market, and such a situation isn’t even addressed by the present law.

The new seismic data does not automatically indicate that the value is greater, because an entire reserve covered by one structure peak, has more value than a reserve which has two structure peaks, as there will be more infrastructure facility costs required in regards to the production.

If a discovery eventuates, ie, 20% chance – then the value will depend on the hydrocarbon content of the structure in altitude, between water and structure peak, or peaks.

We must therefore be extremely careful with the Contract, which will occur re: marine plot 2, and depending on the obstacles and the findings, to be a Win-Win contract, a fact which is very difficult without an overall strategy on the energean issue.

Because it will constitute a new important role model, as was ELF’s Rospo Mare reserve, and AGIP-ENI’s Acquila reserve in the Adriatic – Italian Northern Ionian.

In the event that natural gas or oil is found in the Achilles reserve and with good porosity characteristics, then this strategic reserve will produce for about 50 years and this is the future of our homeland.

So let’s observe the whole matter more cautiously.