24391 - Natural gas target reserves in TOTAL’s Cypriot marine plot 11. (with E. Conophagos and A. Foscolos)

E. Conophagos, N. Lygeros, A. Foskolos

Translated from the Greek by Athena Kehagias

It is a known fact that at the end of 2016, the company Total, which is the operator of the Cyprιοt marine plot 11, is preparing to make its first exploratory drilling.

We believe that it will be a crucial moment for Cyprus, given the magnitude of the expected natural gas reserves in the region, and the absence of any geographical Turkish claim upon those specific plots and reserves.

Based on the three-dimensional (3D) seismic recordings of the Norwegian co, PGS and taking in to account the discovery of the hypergigantic Zohr reserve in the neighbouring marine plot 11, we calculated that the posibility of locating natural gas during Total’s first drilling is about 66%.

Given the average global potential of a hydrocarbon discovery rate of 10%, that probability is quite high.

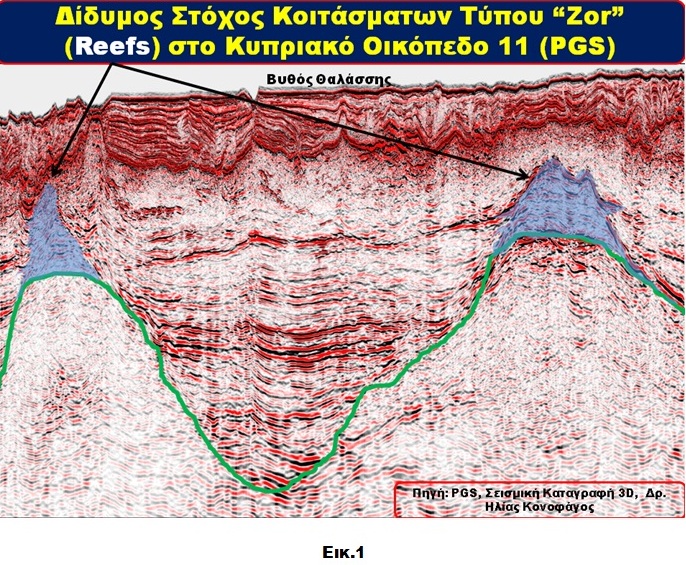

Additionally, it is extremely interesting to state that, in view of the Cypriot third licensing round, the PGS company posted for the first time on its website, reef targets of Miocene limestones (Zohr type) in marine plot 11 (Fig.1).

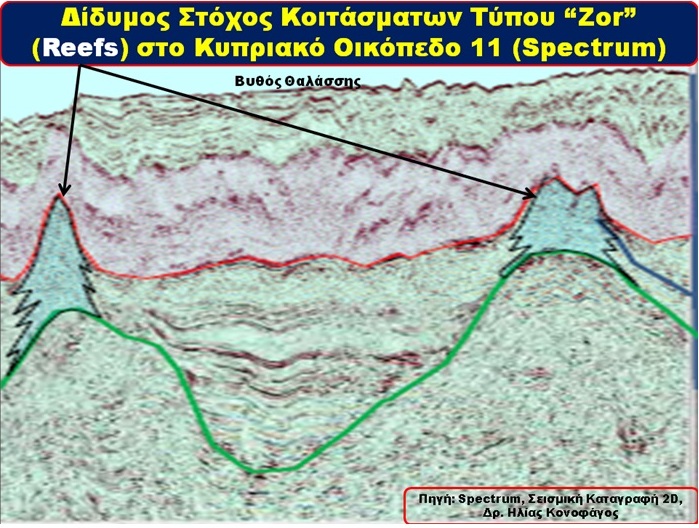

Total’s published twin targets by PGS, within the Cypriot marine plot 11 are however confirmed by another previous independent report of two-dimensional (2D) seismic recordings by the Spectrum Company (Fig.2).

We are also aware (see: our previous publication), that at least 3 reef targets were recorded within marine plot 11, as well as two important targets of the similar type within marine plot 10.

Based on a success probability rate of 66%, re: the above mentioned plots, there is a possibility for a future discovery of three gigantic natural gas fields.

Given the fact that the sea depths (~ 1500 meters) and the drilling depths (~ 4.000m) are relatively small, the utilization of the discoveries could occur at a relatively low cost of reserve exploitations.

Taking into account that we are going through a period of relatively low natural gas prices, a joint venture explotation of the above mentioned twin natural gas targets, through joint floating installations, may lead to an even lower production cost of the Cypriot natural gas reserves.

For this reason, the possibility should not be excluded, ie, of Total within the near future opting for two drillings in marine plot 11, instead of the originally planned single one.

The later of course would eventuate if the first drilling is in actual fact successful.

The question of course remains, to what market would the expected new Cypriot natural gas concentrations be directed.

From a strategic aspect, the presence of Total in Cyprus, which like ENI is not particularly active in Turkey, unlike Shell + British Gas Company, is particularly important.

At this point of time, Cyprus requires high level alliances both in order to withstand the political challenges it faces, and so it could direct the largest part of its natural gas reserves towards Europe, liquefying the rest at Basiliko.

It is now obvious that in the next few years, both the new technical innovations in large sea depths, and the expected significant accumulation of natural gas reserves in the region,

could dramatically reduce the cost of transporting natural gas via pipelines through to Europe, in favour of peace, and the prosperity of our nation.