21700 - Attracting investors re: the South of Crete reserves

E. Conophagos, N. Lygeros, A. Foskolos

Translated from the Greek by Athena Kehagias

Based on recent announcements of our country’s Minister of Energy, there’s a conclusion, that the ministry is not aware if there really is an international investor interest regarding the location and exploitation of natural gas and oil reserves in Greece.

This unfortunate statement did not even take into account, that in actual fact the investor interest is specified in a particular area of petroleum research interest, such as South of Crete, where as it’s well known, there wasn’t any investors, a fact which is unacceptable.

However nobody from the “competent” ministy wondered, why to this day, the last lisencing round in regards to the10 marine plots South of Crete had failed by the previous Minister.

Yet again, the reasons for this failure, for those who know the subject, of course are very simple and can be described as follows:

1. The marine fields South of Crete, are completely unexplored areas, in respect to those in the Ionian Sea, and from a geological perspective they are areas particularly complex, of high economic risk, with relatively great water depths.

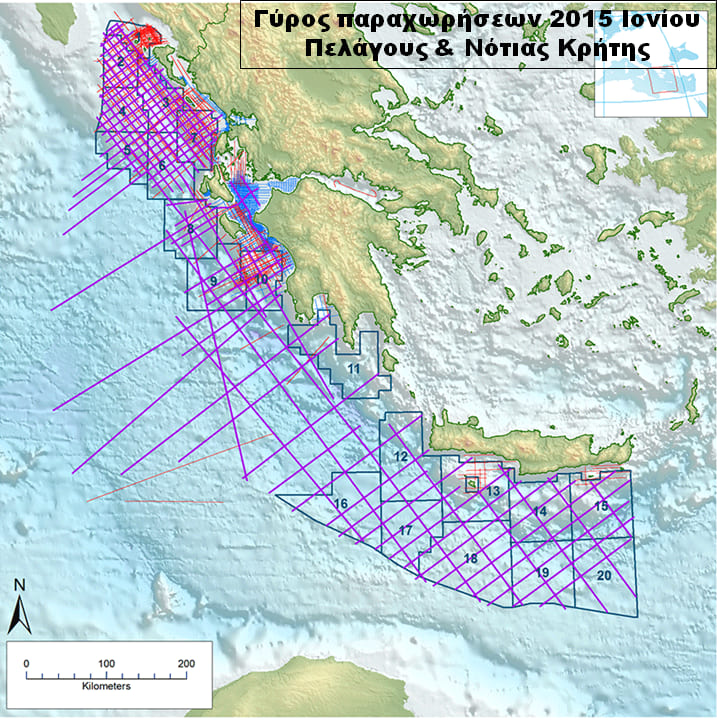

2. For the above mentioned reason, the size of the marine plots in the recent lisencing round, in 2014 to 2015 (Figure 1) should have been greater in size in the case of the South of Crete region, and they should have been the subject of a special, separate international lisencing round.

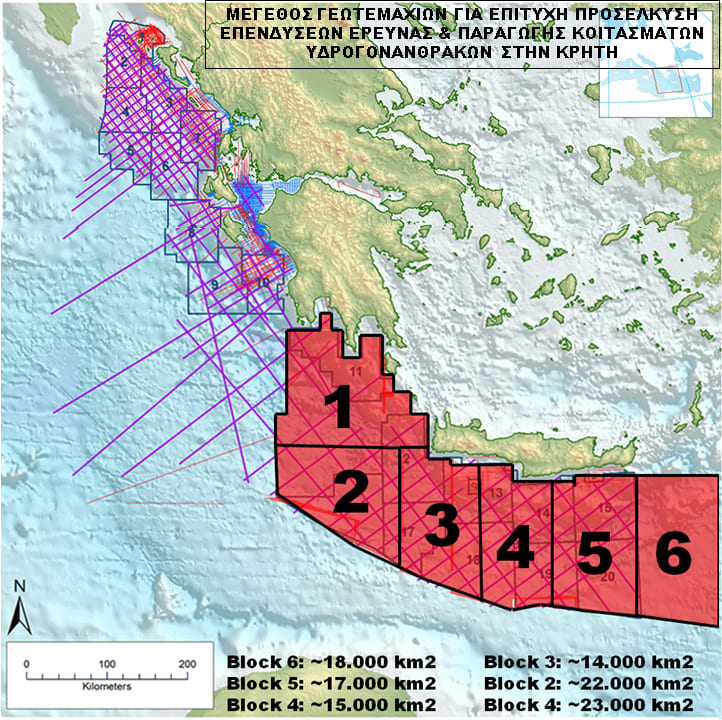

3. In order for a South of Crete international lisencing round, aiming to attract investment, to be successful, according to our point of view, the areas of the marine plots in the region should be between 15,000 and 25,000 square kilometers in size(Fig.2).

4. The above mentioned marine plot size (Eik.2) could provide important investments in the South of Crete region, with a corresponding turnout of reliable and large oil companies.

In actual fact, the large plots, maximize the probability of location of mainly valuable natural gas target reserves, simultaneously reducing the total investment’s financial risk, otherwise, only small companies would play, which don’t of course have the same capabilities, both financial and technical.